Managing your finances effectively is crucial for achieving financial stability and security. Creating a monthly budget is a fundamental step in this process, allowing you to track your income and expenses, identify areas of wastage, and make informed decisions about your money.

Effective budget planning involves more than just tracking expenses; it’s about understanding your financial goals and aligning your spending with these objectives. By doing so, you can ensure that your money is being utilized in the best possible way.

With a well-structured budget, you can reduce financial stress, achieve your financial goals, and secure a more stable financial future. It’s about taking control of your finances and making conscious decisions about how you spend your money.

Key Takeaways

- Understand the importance of creating a monthly budget.

- Learn how to track your income and expenses effectively.

- Identify areas where you can cut back on unnecessary expenses.

- Align your spending with your financial goals.

- Reduce financial stress and achieve stability.

Why Most Budgets Fail (and How to Make Yours Different)

The key to a successful budget lies in understanding the reasons behind the failure of most budgets. Many individuals struggle with managing their finances effectively, often due to common pitfalls that can be avoided with the right strategies.

Common Budget Pitfalls to Avoid

Several factors contribute to the failure of budgets. Understanding these can help in creating a more effective budgeting plan.

Unrealistic Expectations

Setting unrealistic financial goals can lead to disappointment and abandonment of the budget. It’s crucial to set achievable targets based on your financial situation.

Lack of Flexibility

A budget that doesn’t allow for flexibility can be too rigid to follow. Life is unpredictable, and your budget should be able to accommodate unexpected expenses.

Ignoring Small Expenses

Small, frequent expenses can add up and derail a budget. Tracking every expense, no matter how small, is essential for maintaining a realistic budget.

| Common Pitfalls | Impact on Budget | Solution |

|---|---|---|

| Unrealistic Expectations | Leads to disappointment and abandonment | Set achievable financial goals |

| Lack of Flexibility | Makes the budget too rigid | Allow for adjustments and unexpected expenses |

| Ignoring Small Expenses | Can lead to significant unaccounted expenditures | Track every expense |

The Psychology Behind Successful Budgeting

The psychological aspect of budgeting is just as important as the financial aspect. Building positive money habits and overcoming financial anxiety are crucial for long-term success.

Building Positive Money Habits

Developing good financial habits takes time and discipline. Consistency is key to making these habits stick.

Overcoming Financial Anxiety

Financial anxiety can be a significant barrier to successful budgeting. Seeking support and education on financial management can help alleviate this anxiety.

Assessing Your Current Financial Situation

Understanding your current financial situation is the foundation of effective budget planning. It involves taking a thorough look at your income, expenses, and overall financial health to make informed decisions.

Tracking Your Income Sources

To assess your financial situation, start by tracking all your income sources. This includes:

- Regular income from your job or business

- Any side hustles or freelance work

- Passive income from investments or rental properties

Salary and Regular Income

Your salary or regular income is likely your most significant source of income. Ensure you account for the net amount you receive after taxes and other deductions.

Side Hustles and Passive Income

In addition to your regular income, consider any side hustles or passive income streams. These can significantly impact your overall financial situation.

Identifying All Expenses

Next, identify all your expenses to understand where your money is going. Categorize them into:

- Fixed costs, such as rent or mortgage

- Variable costs, like groceries or entertainment

Fixed vs. Variable Costs

Fixed costs remain the same each month, while variable costs can fluctuate. Understanding this distinction helps in managing your expenses effectively.

Hidden Expenses to Watch For

Be aware of hidden expenses, such as subscription services or maintenance costs, which can add up quickly.

Calculating Your Net Cash Flow

Finally, calculate your net cash flow by subtracting your total expenses from your total income. This will give you a clear picture of your financial health.

Using Financial Statements

Utilize your bank and credit card statements to accurately track your income and expenses.

Identifying Financial Leaks

Look for areas where you can cut back on unnecessary expenses, often referred to as financial leaks.

By following these steps, you’ll have a comprehensive understanding of your financial situation, enabling you to make informed decisions and set realistic financial goals.

Setting Clear Financial Goals

Establishing clear financial goals is the cornerstone of effective budgeting. By defining what you want to achieve, you can create a tailored plan that suits your financial situation and aspirations.

Short-Term vs. Long-Term Goals

Financial goals can be categorized into short-term and long-term objectives. Short-term goals are typically achieved within a few months to a few years, while long-term goals take longer, often five years or more.

Emergency Fund Targets

A key short-term goal is building an emergency fund to cover 3-6 months of living expenses. This fund acts as a safety net during unexpected events.

Debt Payoff Milestones

Another important goal is setting debt payoff milestones. Identify debts to be paid off and create a timeline for achieving this goal.

Saving for Major Purchases

Saving for major purchases, like a house or a car, is also a common financial goal. Determine the amount needed and set a realistic savings plan.

Making Your Goals SMART

To ensure your financial goals are effective, make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Creating Measurable Milestones

Break down large goals into smaller, measurable milestones. This helps track progress and stay motivated.

Adjusting Goals as Needed

Be prepared to adjust your goals as your financial situation changes. Flexibility is key to successful financial planning.

| Goal Type | Examples | Timeframe |

|---|---|---|

| Short-Term | Emergency fund, debt payoff | Less than 5 years |

| Long-Term | Retirement savings, major purchases | 5 years or more |

Choosing the Right Budgeting Method for Your Lifestyle

The key to successful budgeting lies in choosing a method that aligns with your financial goals and spending habits. With various budgeting strategies available, it’s essential to understand the different approaches to manage your finances effectively.

Zero-Based Budgeting

Zero-based budgeting involves allocating every dollar of your income towards a specific expense or savings goal, ensuring that your income minus expenses equals zero. This method helps in tracking every dollar and making conscious financial decisions.

Who It Works Best For

Zero-based budgeting is ideal for individuals who want to have complete control over their finances and are willing to track every expense meticulously.

Implementation Steps

To implement zero-based budgeting, start by listing all income sources, then categorize expenses, and finally allocate funds to each category, ensuring that the total income minus total expenses equals zero.

50/30/20 Rule

The 50/30/20 rule suggests dividing your income into three categories: 50% for necessary expenses like housing and utilities, 30% for discretionary spending, and 20% for saving and debt repayment. This rule provides a simple and straightforward budgeting framework.

Needs, Wants, and Savings Breakdown

This rule categorizes your income into needs (50%), wants (30%), and savings (20%), helping you prioritize essential expenses while saving for the future.

Adapting the Percentages

Depending on your financial situation, you can adjust these percentages. For instance, if you have high-interest debt, you might allocate more than 20% towards debt repayment.

Envelope System

The envelope system involves dividing your expenses into categories and allocating a specific amount of cash for each category, placing the corresponding amount into an envelope labeled for that category. This visual method helps in sticking to your budget.

Digital vs. Physical Envelopes

While traditional envelope systems use physical cash and envelopes, digital versions use apps to categorize and limit expenses, offering a more convenient alternative.

Category Management

Effective category management is crucial for the envelope system, requiring you to regularly review and adjust category allocations based on spending patterns.

Pay Yourself First Method

The “pay yourself first” method prioritizes savings by setting aside a portion of your income for savings and investments as soon as you receive it, before spending on anything else.

Automation Strategies

Automating your savings through direct deposits or automatic transfers can make it easier to stick to this method, ensuring consistent savings.

Balancing Savings and Expenses

It’s crucial to balance savings with necessary expenses, ensuring that you have enough for both savings and essential expenditures.

How to Create a Monthly Budget That Actually Works

Making a monthly budget that sticks involves more than just tracking expenses; it requires a strategic approach to managing your finances. “A budget is telling your money where to go instead of wondering where it went.” This mindset shift is crucial for effective budgeting.

Step 1: List All Income Sources

Start by identifying all your income sources. This includes your salary, investments, and any side hustles.

After-Tax Income Calculations

Ensure you’re calculating your after-tax income to get a realistic picture of your available funds. This step is crucial for accuracy.

Handling Irregular Income

If you have irregular income, such as freelance work, average your earnings over a few months to establish a baseline.

Step 2: Categorize Your Expenses

Divide your expenses into categories to understand where your money is going.

Essential vs. Non-Essential Spending

Distinguish between essential expenses like rent and utilities, and non-essential spending like dining out or entertainment.

Creating Custom Categories

Tailor your categories to fit your lifestyle. For example, if you have a pet, you might include a “pet expenses” category.

Step 3: Allocate Funds to Each Category

Assign a portion of your income to each category based on your priorities and financial goals.

Priority-Based Allocation

Prioritize essential expenses over non-essential spending.

Using Percentages vs. Fixed Amounts

Decide whether to allocate percentages or fixed amounts to categories. Percentages can offer flexibility with irregular income.

Step 4: Balance Your Budget

Ensure your income covers your expenses. If not, adjust your spending or explore ways to increase your income.

Adjusting When Numbers Don’t Match

If your expenses exceed your income, identify areas to cut back.

Finding Areas to Cut Back

Review non-essential spending to find opportunities for reduction.

Step 5: Implement Your Plan

Put your budget into action by tracking your spending daily or weekly.

Daily and Weekly Monitoring

Regular monitoring helps you stay on track and make adjustments as needed.

First Month Adjustments

Be prepared to make adjustments after the first month based on what you’ve learned about your spending habits.

By following these steps and staying committed, you can create a monthly budget that not only works but also helps you achieve financial stability.

Essential Categories to Include in Your Budget

Effective budget planning involves identifying and allocating funds to crucial expense categories. A well-structured budget is the backbone of personal finance management, helping you navigate through your financial journey with clarity and confidence.

Housing and Utilities

Housing is typically one of the largest monthly expenses. It’s crucial to consider both the fixed costs, such as rent or mortgage, and variable costs like utilities.

Rent/Mortgage Considerations

When budgeting for housing, consider not just the rent or mortgage but also associated costs like property taxes and insurance.

Seasonal Utility Fluctuations

Utilities can vary significantly with the seasons. Planning for these fluctuations can help avoid unexpected expenses.

Food and Groceries

Food expenses can be a significant portion of your budget. Planning meals and being mindful of dining out can help manage these costs.

Meal Planning to Save Money

Planning your meals in advance can reduce food waste and save money by ensuring you only buy what you need.

Dining Out Strategies

Limiting dining out to special occasions or setting a specific budget for it can help keep expenses in check.

| Category | Monthly Budget | Actual Spend |

|---|---|---|

| Housing | $1,500 | $1,550 |

| Food | $500 | $520 |

| Transportation | $300 | $280 |

Transportation

Whether you own a vehicle or use public transportation, there are costs associated with getting from one place to another.

Vehicle Costs Beyond Gas

Owning a vehicle comes with expenses like maintenance, insurance, and registration, in addition to fuel costs.

Public Transit Options

For those using public transit, budgeting for monthly passes or tickets is essential.

Debt Repayment

Managing debt is a critical aspect of financial health. Prioritizing debts and creating a plan to pay them off can significantly reduce financial stress.

Prioritizing High-Interest Debt

Focusing on paying off high-interest debts first can save money in interest over time.

Snowball vs. Avalanche Methods

Deciding between the snowball method (paying off smaller debts first) and the avalanche method (paying off high-interest debts first) depends on your financial situation and personal preference.

“The key to successful budgeting is not just cutting expenses, but also understanding where your money is going and making conscious decisions about how you want to allocate your resources.”

Savings and Investments

Saving for the future and investing wisely are crucial for long-term financial stability and growth.

Retirement Accounts

Contributing to retirement accounts, such as a 401(k) or IRA, is a smart way to save for the future.

Short-Term Savings Goals

Having a savings cushion for short-term goals or emergencies can prevent financial setbacks.

By carefully considering these essential categories and tailoring your budget to fit your needs, you can achieve a more stable financial future.

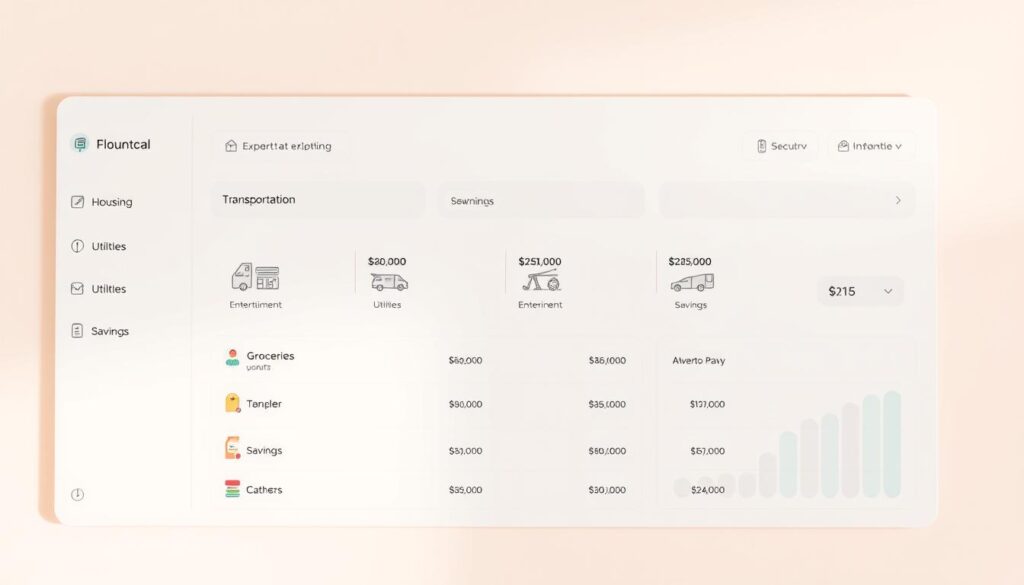

Leveraging Technology: Best Budgeting Tools and Apps

Effective budgeting in the modern era is heavily reliant on the use of budgeting software and applications. With the plethora of options available, individuals can significantly simplify their financial management tasks.

Free vs. Paid Budgeting Software

When it comes to budgeting tools, one of the primary considerations is whether to opt for free or paid software. Free budgeting tools can be a great starting point, offering basic features that can help individuals manage their finances.

Popular Free Options

Tools like Mint and Personal Capital are highly regarded for their comprehensive financial tracking capabilities. They offer features such as expense categorization, bill tracking, and investment monitoring.

Premium Features Worth Paying For

While free tools are beneficial, paid budgeting software often provides additional features such as advanced investment tracking, customized budgeting plans, and enhanced security. These premium features can be particularly valuable for individuals with complex financial situations.

Features to Look for in Budgeting Apps

When selecting a budgeting app, there are several key features to consider. These include bank syncing capabilities, reporting and visualization tools, and user-friendly interfaces.

Bank Syncing Capabilities

Bank syncing allows for real-time tracking of your financial transactions, making it easier to stay on top of your budget. Apps like Mint and YNAB (You Need a Budget) offer robust syncing capabilities.

Reporting and Visualization Tools

Effective budgeting apps also provide reporting and visualization tools, helping users understand their spending patterns and financial progress. These tools can be invaluable for making informed financial decisions.

| Feature | Mint | Personal Capital | YNAB |

|---|---|---|---|

| Bank Syncing | Yes | Yes | Yes |

| Investment Tracking | Limited | Yes | No |

| Budgeting Tools | Yes | Yes | Yes |

Strategies for Sticking to Your Budget

The key to successful budgeting lies not in creating a perfect budget but in sticking to it over time. Effective budgeting is about developing budgeting strategies that become habits, ensuring long-term financial health.

Creating Accountability Systems

Having someone to report to can significantly enhance your commitment to your budget. This is where accountability systems come into play.

Budgeting Partners and Groups

Joining a budgeting group or finding a budgeting partner can provide the support and motivation needed to stay on track.

Regular Check-ins and Reviews

Regularly reviewing your budget helps identify areas for improvement and keeps your financial goals in focus.

Automating Your Finances

Automation is a powerful tool in maintaining a budget. By automating certain financial tasks, you can ensure consistency and reduce the likelihood of overspending.

Bill Pay Automation

Automating bill payments ensures that your bills are paid on time, avoiding late fees.

Automatic Transfers to Savings

Setting up automatic transfers to your savings or investment accounts helps build savings without having to think about it.

Building in Rewards and Incentives

Rewarding yourself for sticking to your budget can be a great motivator. It’s about finding a balance between saving and enjoying your money.

Celebrating Financial Milestones

Acknowledge and celebrate your financial achievements along the way to stay motivated.

Creating a “Fun Money” Category

Allocating a small portion of your budget to “fun money” allows you to enjoy your life while still being responsible with your finances.

By implementing these personal finance tips, you can create a budgeting system that is not only effective but also sustainable in the long term.

Handling Irregular Expenses and Financial Emergencies

A well-structured budget must account for both regular monthly expenses and irregular financial obligations. Effective budgeting techniques involve preparing for unexpected expenses and financial emergencies.

Building an Emergency Fund

One of the most critical components of financial goal setting is building an emergency fund. This fund acts as a safety net during financial emergencies, helping you avoid debt and stay on track with your financial goals.

Starting with a Mini Emergency Fund

Begin by saving a small amount, such as $1,000, to cover minor emergencies. This initial fund can help you navigate small financial shocks, such as car repairs or medical bills.

Reaching 3-6 Months of Expenses

The ultimate goal is to save enough to cover 3-6 months of living expenses. This larger fund provides a more substantial safety net, giving you peace of mind and financial security in the face of more significant emergencies or job loss.

Planning for Non-Monthly Expenses

In addition to building an emergency fund, it’s essential to plan for non-monthly expenses. These can include annual insurance premiums, property taxes, and holiday expenses.

Creating Sinking Funds

A sinking fund is a separate savings account dedicated to a specific non-monthly expense. By setting aside a portion of your income each month, you can avoid the financial strain of large, infrequent expenses.

Anticipating Seasonal Costs

Some expenses, like heating bills in winter or holiday expenses, are seasonal. Anticipating these costs and budgeting for them in advance can help prevent financial stress.

By incorporating these strategies into your budgeting plan, you can better manage irregular expenses and financial emergencies, ensuring a more stable financial future.

Adjusting Your Budget as Life Changes

Your budget is not a static document; it needs to evolve with your life circumstances. As your income, expenses, and financial goals change, so too should your budget. Regular adjustments ensure that your budget remains a relevant and effective tool in managing your finances.

Monthly Budget Reviews

Conducting monthly budget reviews is crucial for staying on top of your finances. This process involves closely examining your spending habits and financial progress.

Analyzing Spending Patterns

During your monthly review, analyze your spending patterns to identify areas where you can improve. This might involve categorizing your expenses and comparing them against your budget allocations.

Making Incremental Improvements

Based on your analysis, make incremental improvements to your budget. This could mean adjusting your budget categories, reducing unnecessary expenses, or allocating more funds to savings and investments.

Major Life Events and Your Budget

Significant life events, such as career changes, family changes, or relocations, can have a substantial impact on your financial situation. Your budget should be adjusted accordingly to reflect these changes.

Career Changes and Income Shifts

If you’ve experienced a career change or income shift, your budget needs to be updated to reflect your new financial reality. This might involve adjusting your income projections and expense allocations.

Family Changes and Relocations

Family changes, such as having a child, or relocations to a new city or state, can significantly impact your expenses. Your budget should be revised to accommodate these changes, ensuring that you’re prepared for the financial implications.

Overcoming Common Budgeting Challenges

Overcoming budgeting challenges requires a combination of the right mindset, strategies, and tools. Budgeting is not a static process; it evolves with your financial situation and goals. Here, we’ll explore some common challenges and practical solutions to help you stay on track.

When Income is Variable

Managing finances with a variable income can be daunting, but there are strategies to make it more manageable.

Budgeting with Commission-Based Pay

For those with commission-based pay, budgeting can be challenging due to the unpredictability of income. A solution is to average your income over a few months to create a more stable budget baseline.

Freelancer and Gig Worker Strategies

Freelancers and gig workers can benefit from setting aside a portion of their income for taxes and irregular expenses. Using a budgeting app can help track irregular income and expenses.

Managing Shared Finances

When managing finances with a partner, communication and agreement on financial goals are crucial.

Couples Budgeting Approaches

Couples can choose from various budgeting approaches, such as joint or separate accounts, depending on what works best for their relationship.

Joint vs. Separate Accounts

Whether to use joint or separate accounts depends on the couple’s financial goals and spending habits. Some couples prefer a hybrid approach, using both joint and separate accounts.

Getting Back on Track After Overspending

Overspending can derail even the best-laid budgets, but there are ways to get back on track.

No-Spend Challenges

Implementing a no-spend challenge can help curb unnecessary expenses and refocus on budget priorities.

Budget Reset Techniques

Regularly reviewing and adjusting your budget can help identify areas for improvement and get your finances back on track.

Conclusion: From Budget Plan to Financial Freedom

Creating a monthly budget that actually works is a crucial step towards achieving financial freedom. By understanding the common pitfalls of budgeting and implementing effective budgeting techniques, you can take control of your finances and make progress towards your financial goals.

Throughout this article, we’ve explored the essential steps to create a budget that works for you, from assessing your financial situation to choosing the right budgeting method and leveraging technology to stay on track. By following these steps and maintaining a commitment to your financial plan, you can overcome common budgeting challenges and achieve long-term financial stability.

Effective budgeting is not just about restricting your spending; it’s about making conscious financial decisions that align with your goals. By adopting the strategies outlined in this article, you’ll be well on your way to creating a monthly budget that not only works but also brings you closer to financial freedom. Start your journey today and discover the peace of mind that comes with having a clear financial plan in place.